Understanding the Quarterly Tax Package

How to View Your Company's Tax Package

-

Login to auth.certipay.com

-

Select the Reports tab in the top blue ribbon

-

Click Documents

-

You will be able to view all documents submitted on your company's behalf to Federal and State agencies.

Understanding Your Quarterly Tax Package

What is included in your company quarterly tax package?

The Reconciliation Recap, Deposit Recap, Form 940 (FUTA Deposit Notice), Form 941 (Employer’s Quarterly Federal Tax Return) and a copy of all state tax returns filed on your behalf, by CertiPay, for that specific year and quarter.

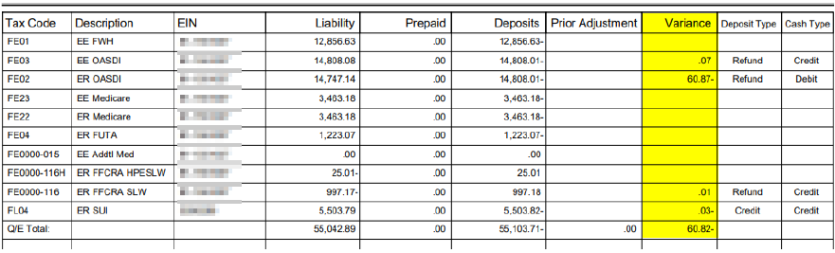

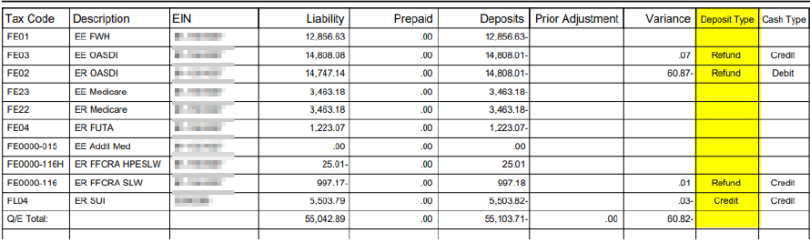

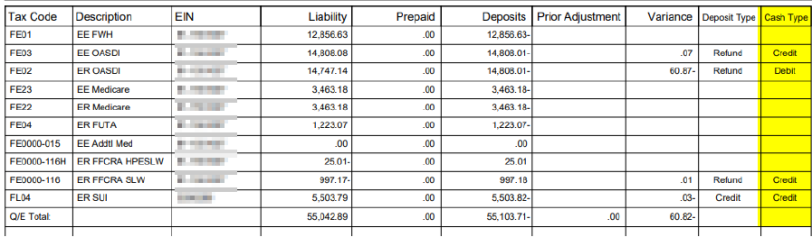

What is the Reconciliation Recap?

This is a summary of activity on your account for each tax type that CertiPay handles on the company’s behalf. Each line displays the tax liability, prepaid deposits, tax deposits, prior period adjustments and the variance.

What is the Deposit Recap?

The Deposit Recap is a quarterly summary of tax liability deposits made on behalf of your company and includes the Tax Code and Description, EIN or State Tax Account ID, Period End date, Due Date, Created (transaction) date, Deposited date, Method of deposit, Type, Confirmation, and Total Tax. Federal taxes withheld are deposited to the IRS based on the company’s tax deposit requirements (monthly or semiweekly). The determination is based on the amount of an employer’s total liability for federal income withholding, social security, and Medicare taxes during a lookback period that generally looks back over a 12-month period.

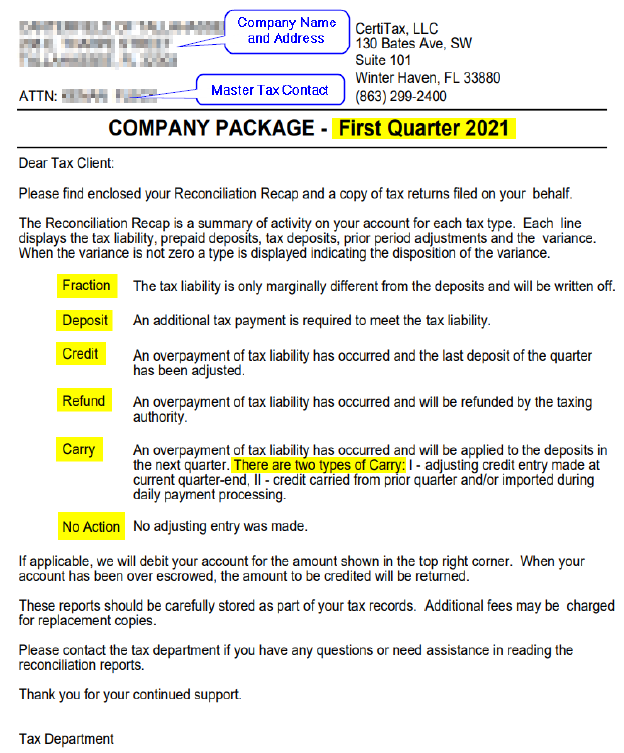

The first page of the Tax Package is a cover letter that includes your company information, quarter and year, and other helpful information that will help you to understand and read your package.

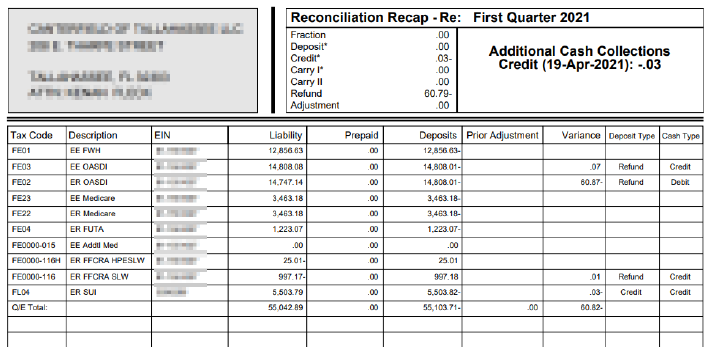

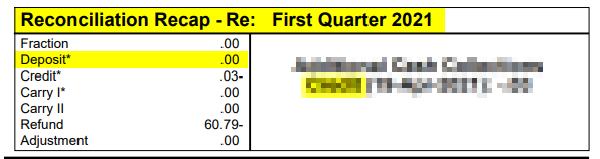

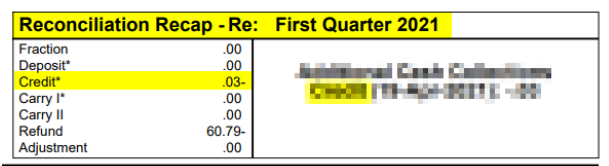

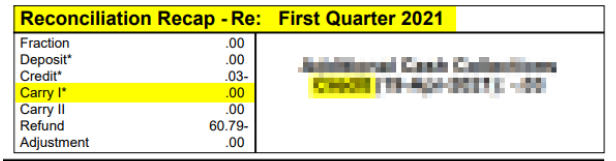

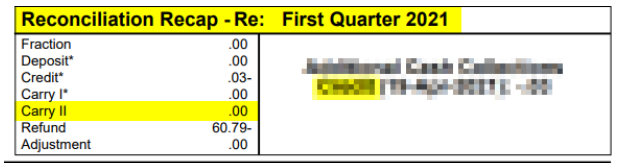

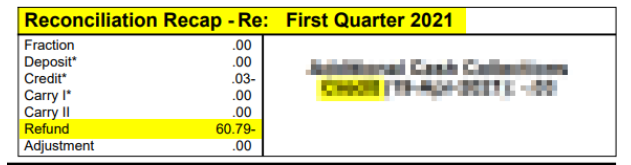

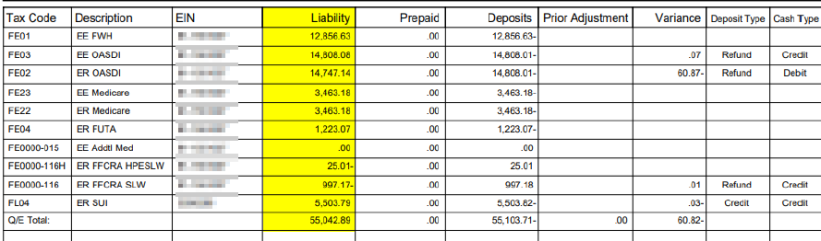

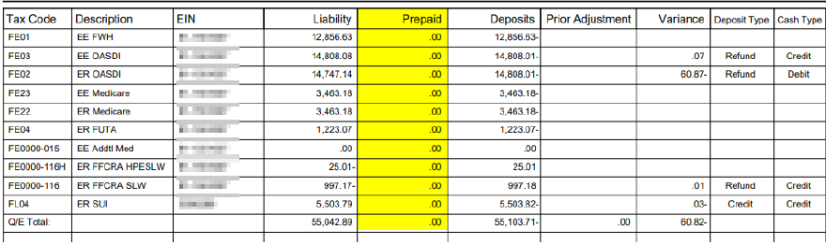

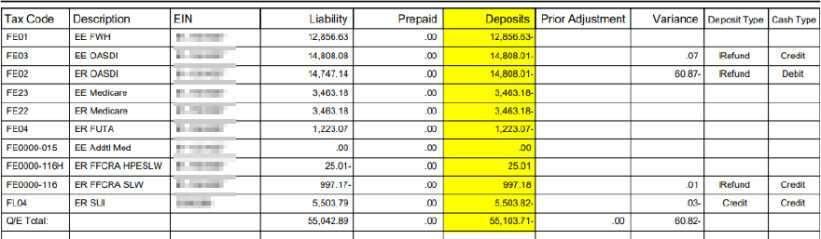

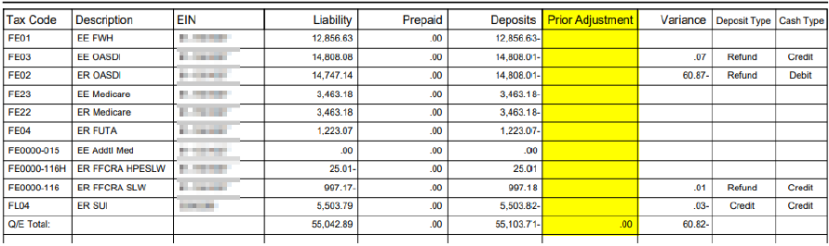

Reconciliation Recap

This recap is a summary of activity on your account for each tax type.

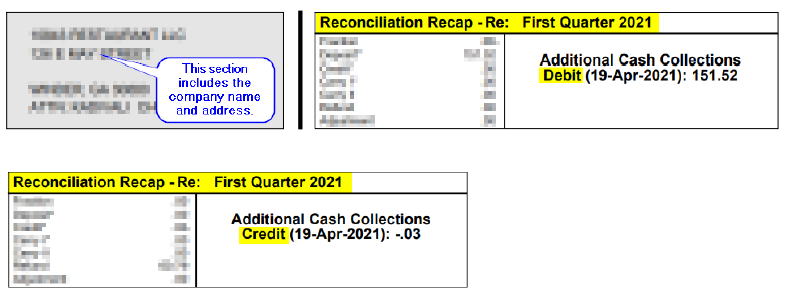

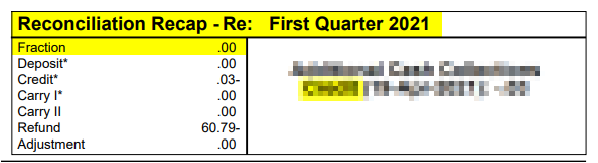

The amount shown in the top right corner of the Reconciliation Recap will show the Additional Cash Collection that may need to be collected in order to fulfill your tax liability for the quarter. Taxes will debit your account for the amount shown in the top right corner on the date listed in parenthesis. You will see this listed as a Debit.

However, you could see a Credit which means an overpayment of tax liability has occurred and the last deposit of the quarter has been adjusted.

Understanding the Deposit Tax Types

Fraction: The tax liability is only marginally different from the deposits and will be written off.

Deposit: An additional tax payment is required to meet the tax liability.

Credit: An overpayment of tax liability has occurred and the last deposit of the quarter has been adjusted.

Carry I: Adjusting credit entry made at current quarter-end.

Carry II: Credit carried from prior quarter and/or imported during daily payment processing.

Refund: An overpayment of tax liability has occurred and will be refunded by the taxing authority.

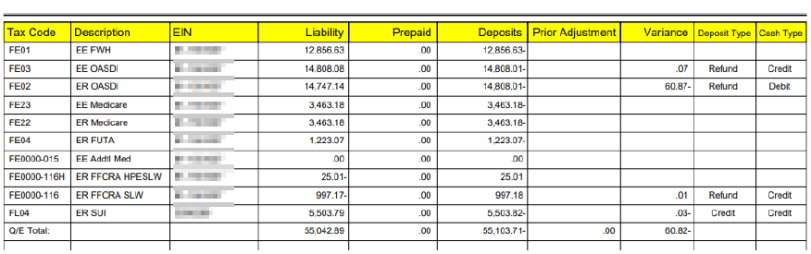

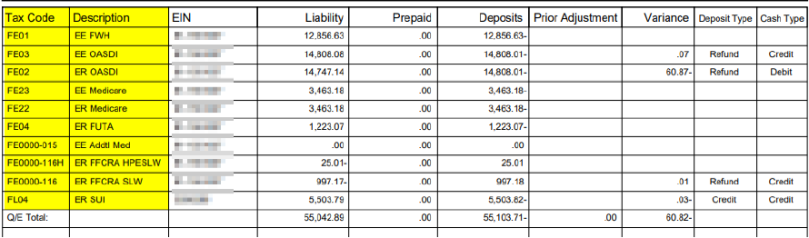

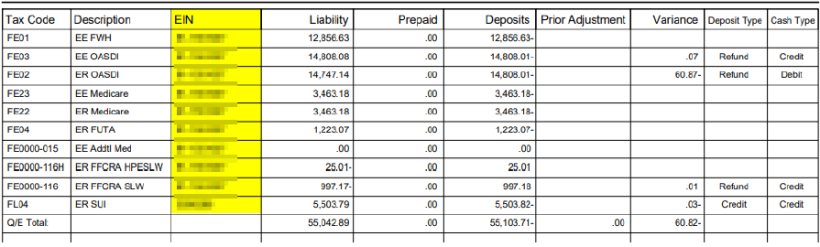

Below this information will include a breakdown of each transaction and will include the Tax Code, Description, EIN or State Account ID, Liability, Prepaid, Deposits, Prior Adjustment, Variance, Deposit Type, and Cash Type.

Tax Code and Description:

The first two letters of the tax code help to identify the type of tax, whether Federal or State. For example, FE is for Federal and the description will tell you whether the tax is for the employee (EE) or the employer (ER) and whether or not it is for federal withholding (FWH), social security taxes (OASDI), or C19/ERTC (EE Addtl. Med, ER HPESLW, ER SLW, ER CARES ERC, ER CARES HPEERC). If the tax code does not begin with FE, then this indicates it is state withholding. For example, FL for Florida, GA for Georgia, etc., and the Description will specify whether it is state withholding (SWT), state unemployment (SUI), or a local tax.

EIN: Employer Identification Number or State Tax Account ID Number

Liability: Total tax liability for the quarter.

Prepaid: This amount pertains to clients that start Mid-Quarter with CertiPay.

Deposits: The amount already collected from the client throughout the quarter.

Prior Adjustment: Any adjustments that were processed for prior periods that are being used in the current quarter

Variance: The difference between the collected tax and the tax liability amount actually owed.

Deposit Type: Method in which funds were deposited. Please reference Understanding the Deposit Tax Types beginning on page 6 of this document for the description of each deposit type.

Cash Type: Examples: Debit, Credit, No Action

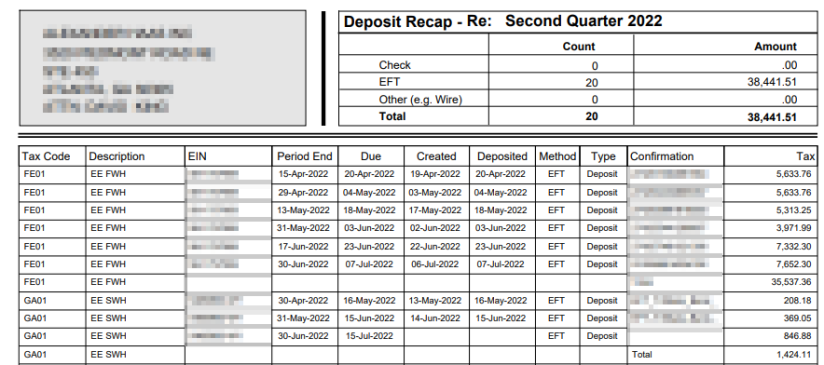

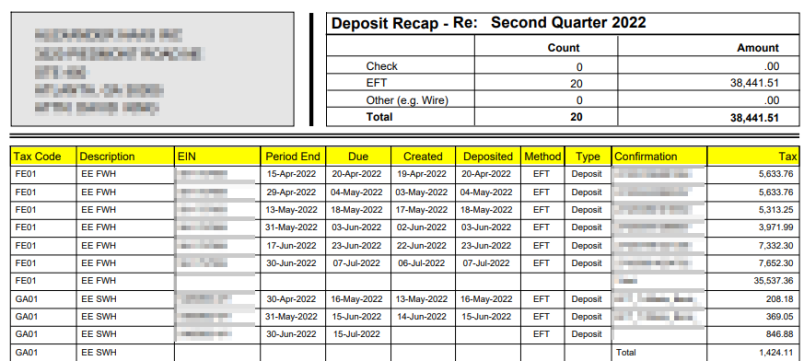

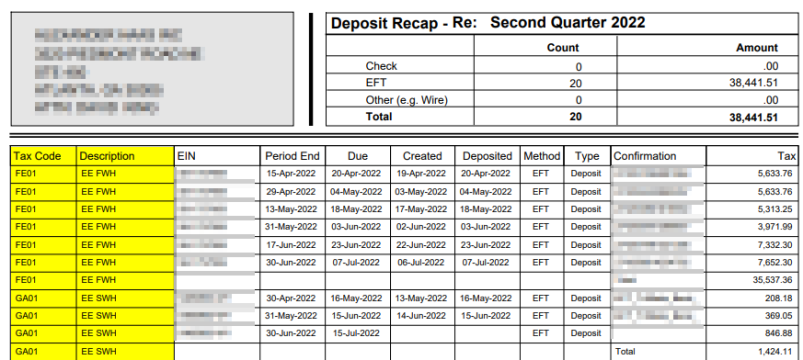

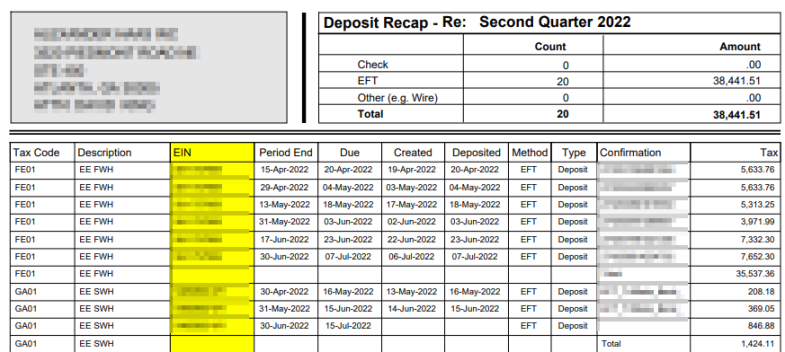

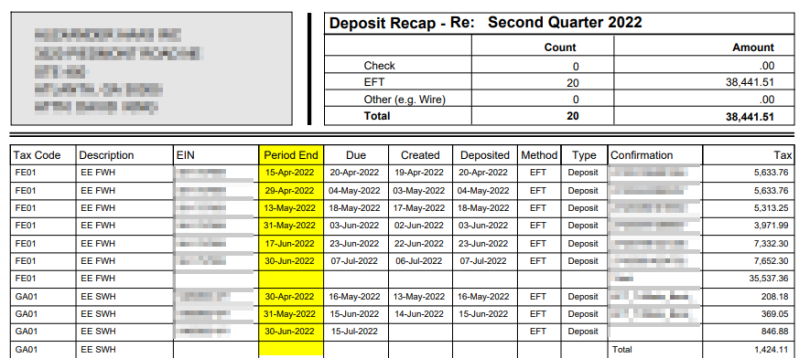

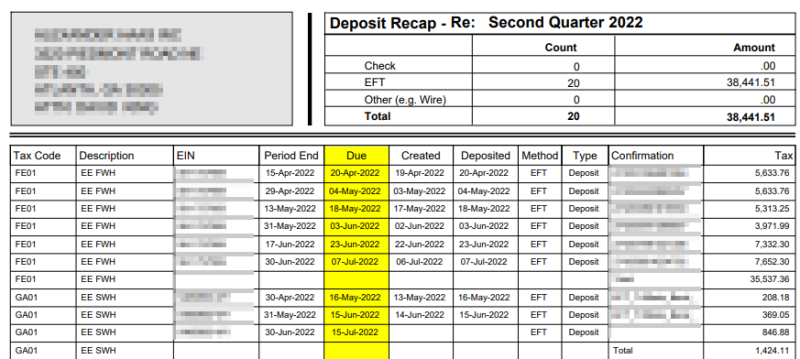

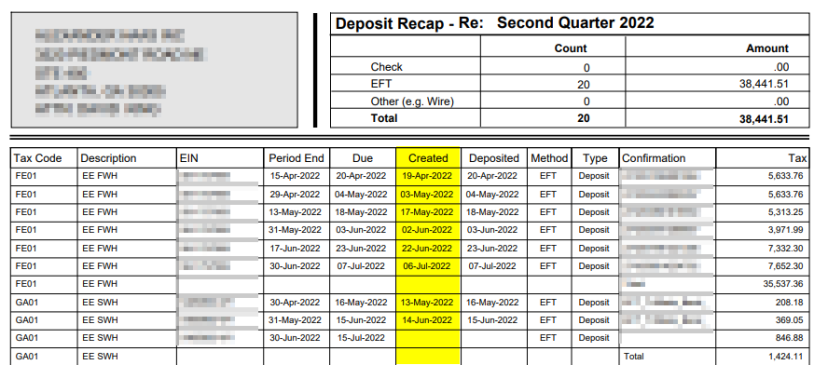

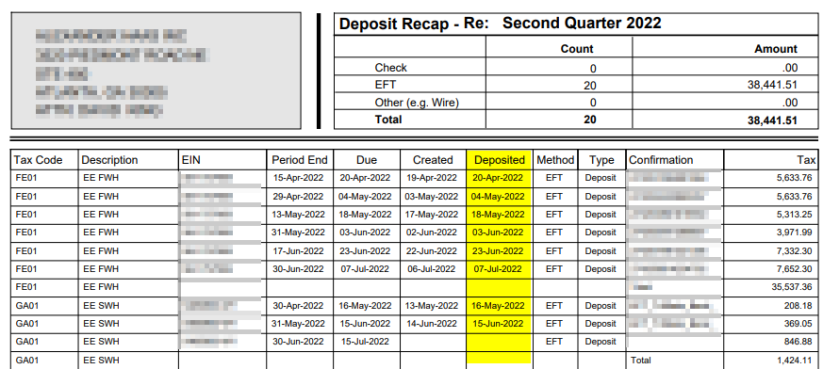

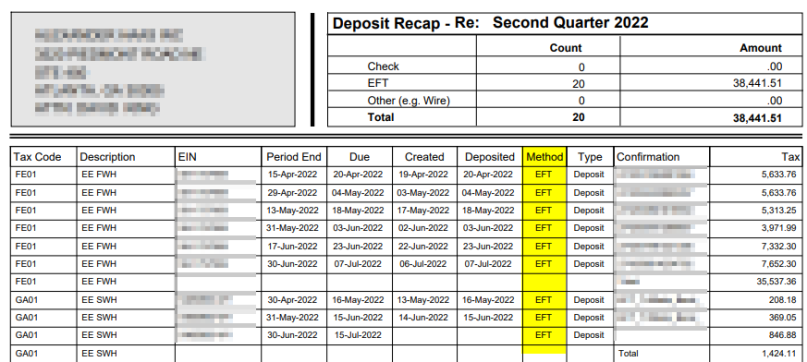

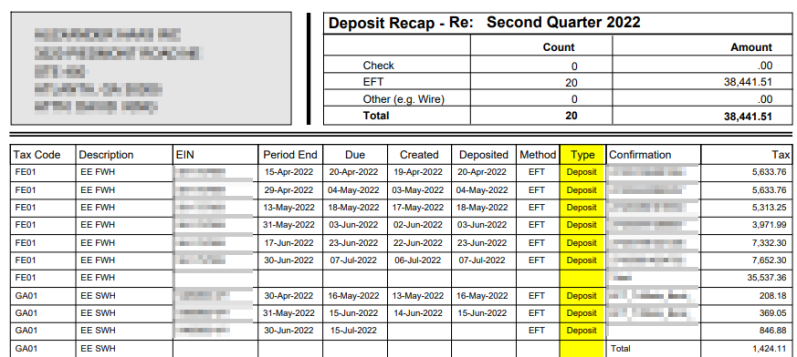

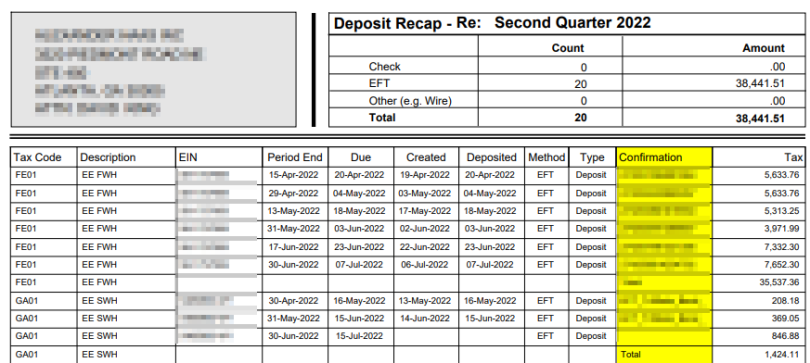

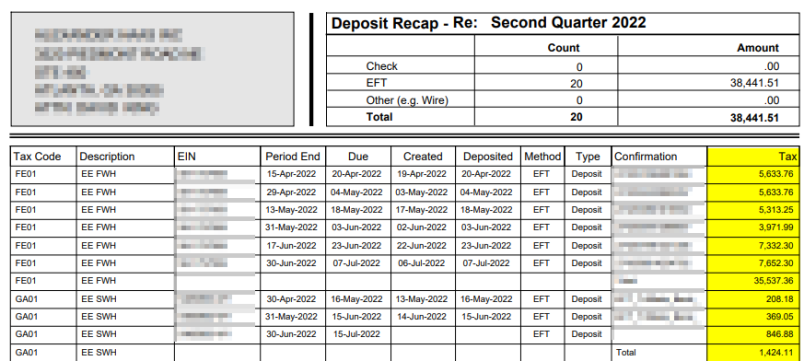

Deposit RecapThe Deposit Recap is a quarterly summary of tax liability deposits made on behalf of your company.

The top right section of the Deposit Recap shows the deposit method, the deposit count, and the total amount of the deposits made throughout the quarter. For example, the recap for this client shows 9 total deposits made through EFT (Electronic Funds Transfer) in the total amount of $38,441.51 for Quarter 2 2022.

Below this information will include a breakdown of each transaction and includes the Tax Code, Description, EIN or State Account ID, Period End, Due Date, Created date, Deposit date, Method, Type, Confirmation, and the total tax liability collected or refunded.

Tax Code and Description: The first two letters of the tax code help to identify the type of tax, whether Federal or State.

For example, FE is for Federal and the description will tell you whether the tax is for the employee (EE) or the employer (ER) and whether or not it is for federal withholding (FWH) and federal unemployment tax (FUTA). If the tax code does not begin with FE, then this indicates it is state withholding. For example, FL for Florida, GA for Georgia, etc, and the Description will specify whether it is state withholding (SWT), state unemployment (SUI), or a local tax.

EIN: Employer Identification Number or State Tax Account ID Number

Period End: For federal withholding (FWH), these are the check dates throughout the quarter that tax liability was collected for deposit. For federal unemployment (FUTA) and state unemployment (SUI), this is the last day of the quarter.

Due: Date the tax liability is due

Created: Date the transaction was created.

Deposited: Date the tax liability was paid.

Method: Method of payment – Check, EFT (Electronic Funds Transfer) or other

Type: Typically the type is a Deposit, Refund or Quarter for a one time quarterly payment.

Confirmation: Deposit/Payment confirmation number

Tax: Total amount deposited or refunded

Also included in your tax package are Form 940 (FUTA Deposit Notice), Form 941 (Employer’s Quarterly Federal Tax Return) and a copy of all state tax returns filed on your behalf, by CertiPay, for that quarter.

For more information on how to read and understand the federal tax forms and/or state forms, please visit the IRS website or the state website.